Is Leave Encashment Taxable?

Posted On:- 21 October, 2025 By:- Vaibhav Maniyar

Quick Answer

Yes, leave encashment is taxable, but significant tax exemptions are available.

During Employment:

The amount is fully taxable as part of the salary.

At Retirement/Resignation:

It can be partially or fully exempt from tax, depending on the employer.

Maximum Exemption (Private Employees):

The lifetime leave encashment exemption limit is ₹25 lakhs.

During Employment:

The amount is fully taxable as part of the salary.

Introduction

The most critical question for any salaried employee planning their finances is, is leave encashment taxable? The short answer is yes, but the complete answer is more nuanced. Consequently, understanding the rules is vital for maximizing the take-home pay when an individual retire or switch jobs. This guide provides a definitive analysis of how this income is taxed under the Income Tax Act, 1961, specifically under the provisions of Section 10 10AA of Income Tax Act leave encashment.

Leave Encashment Tax: At a Glance

To clarify, the tax treatment changes based on when the individual receives the money.

Received |

Tax Treatment |

Available Exemption |

|---|---|---|

While still employed |

Fully taxable |

No (however, relief under Section 89 is possible) |

At retirement/resignation (Govt) |

Tax-free |

Yes (100% exempt) |

At retirement/resignation (Private/PSU) |

Partially exempt |

Yes (up to the ₹25 lakh statutory limit) |

Received by legal heirs after death |

Tax-free |

Yes (100% exempt) |

Leave Encashment Meaning

First, let's define what is leave encashment. The leave encashment meaning refers to the process where an employee receives a cash payment from their employer in exchange for their unused paid leave. In essence, it is the encashment of earned leave. Depending on the company’s policy, leave encashment could happen annually or at the time of retirement. However, it is doable to get the encashment amount upon resignation if it is impromptu.

As part of the final settlement, some organizations allow for annual or periodic encashment of unused leave, while others may have specific "encashment windows". Remember, that the eligibility is primarily determined by the internal policy. However, the Factories Act or the Shops and Establishments Act, do not specify a minimum balance for encashment itself. Money is usually given for unused "earned leave" or "privilege leave" and is paid based on a formula that uses the basic salary and dearness allowance. Casual leave is intended for short-term, unexpected needs and does not accumulate or get carried over.

Legal Definition:

"Any payment received by an employee as the cash equivalent of the leave salary in respect of the period of earned leave at his credit at the time of his retirement whether on superannuation or otherwise".

Related: Paid Holidays & Leave Laws in India

Leave Encashment Situation-Wise Breakdown

As mentioned earlier, the core issue of whether leave encashment is taxable or not depends entirely on when the person receives the money.

Encashing Leave While Still Working

A common query is, "is earned leave encashment taxable during the course of employment?" The answer is unequivocally yes. Cashing out leaves while still employed, the entire amount is added to income and taxed at applicable slab rate. In this situation, one can claim tax relief under Section 89(1) by filing Form 10E to avoid being pushed into a higher tax bracket.

Leave Encashment at Retirement

This is where the valuable exemptions come into play. The question "is leave encashment taxable on resignation?" has a different answer depending on the employer type. In fact, this is where most tax planning opportunities lie, particularly on retirement. Encashment received by Central or State Government employees at the time of retirement is fully exempt from income tax under Section 10(10AA) of the Income Tax Act. This exemption is 100% and has no monetary limit. For employees of the private sector, public sector undertakings (PSUs), or banks, the encashment on retirement is partially exempt and partially taxable.

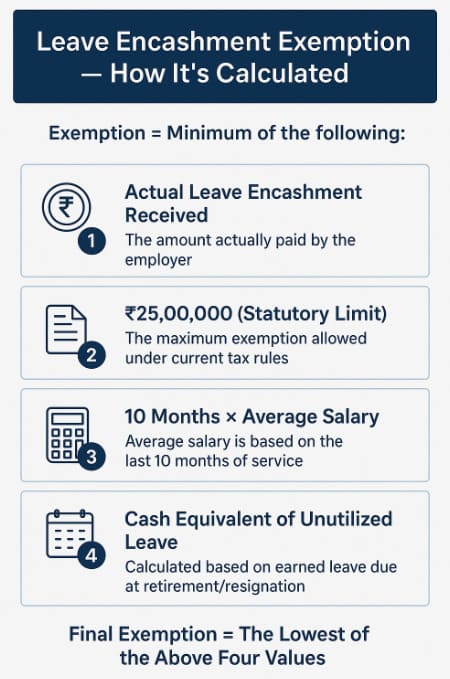

Conditions for Private/PSU Employees

For non-government employees, a leave encashment exemption calculation is required. The amount of the leave encashment tax exemption is the LOWEST of the following four amounts.

As mentioned earlier, mastering this leave encashment formula is key to understanding tax liability. Let's break down each component.

Actual Amount Received

This is simply the gross payment receive from employer as part of final settlement.

Statutory Limit: ₹25,00,000

This is the maximum lifetime exemption limit, updated from ₹3 lakhs in May 2023. As a result, if an individual has already claimed a ₹5 lakh exemption from a previous job, he/she only has a ₹20 lakh limit remaining. This is a lifetime limit (not per employer) and is cumulative across all jobs.

Ten Months' Average Salary

Critically, "salary" for this purpose only includes basic salary, dearness allowance (if it forms part of retirement benefits) and a commission as a fixed percentage of turnover. Remember, any sort of allowances or PF contribution is not included. Therefore, one must calculate the average of the last 10 months' salary immediately preceding the retirement.

Cash Equivalent of Unutilised Leave

The leave encashment calculation formula is:

(Unutilised Leave Days ÷ 30) × Monthly Average Salary

Here's how to calculate leave encashment's cash equivalent:

step

Count only the completed years of service for earned leave calculations, ensuring strict compliance with statutory requirements and tax-approved leave encashment rules, which clearly specify that partially completed years such as 20 years and 11 months are still treated as exactly 20 years only.

step

As per earned leave encashment rules, calculate total leave eligibility for tax purposes (Completed years × 30 days) accurately and based on statutory limits. Even if the company offers 45 days a year, the tax law strictly caps it at 30 days per year.

step

Subtract the total number of leaves already taken by the employee throughout their period of employment, ensuring that only the eligible unused leave balance remains for calculation, because encashment is allowed strictly on the accumulated leave that has not been previously availed.

step

Use the resulting balance in the prescribed earned leave encashment formula to determine the applicable cash value for tax purposes, ensuring accurate financial computation while strictly following legal requirements so that the final payout amount remains fully compliant with current statutory regulations.

Related: The Ultimate Leave Letter Guide for Every Situation

Is Leave Encashment Taxable in New Regime?

A frequently asked question is, "is leave encashment taxable in new regime?" The answer is yes, the tax exemption received at the time of retirement or resignation is available to employees under the new income tax regime. This key benefit, covered under Section 10(10AA) of the Income Tax Act, was not removed when the new, concessional tax structure was introduced.

Importantly, the leave encashment exemption under the section 10 10aa of income tax act is available in both the old and new tax regimes, making it especially valuable for retirement planning.

Key Points:

Unlike many other deductions that were removed from the new regime, this tax exemption was retained

The ₹25 lakh exemption limit applies equally in both regimes

This makes it a valuable tax-saving tool regardless of which regime is taken

" This exemption remains one of the few benefits that work uniformly across both tax structures."

The ₹25 lakh exemption is a lifetime limit for an individual, meaning the total exemption claimed from one or more employers throughout a person's career cannot exceed this amount. If an employee's legal heirs receive the encashment amount after the employee's death, the entire sum is fully tax-exempt in their hands.

Factors Affecting Leave Encashment Exemption

As per earned leave encashment rules, the company may give 60 days/year, but tax law recognizes only 30 days/year maximum. Similarly, there are other factors that could affect exemption. Some of them are:

Type of Employer

The primary factor determining the tax treatment is the nature of the employer. For individuals employed by the Central or State Government, the rules are very straightforward. The entire amount they receive as cash for their accumulated earned leave at the time of retirement is fully exempt from income tax, without any upper limit.

In contrast, the exemption for non-government employees, which includes those working in the private sector and for public sector undertakings, is subject to specific limits. The exempt portion is calculated based on the lowest of four specific criteria, making it essential to understand the factors that feed into this calculation.

Duration of Completed Service

The total number of years an employee has rendered service to the employer is a fundamental component of the exemption calculation. The framework for tax exemption is based on a maximum leave entitlement of 30 days for every single year of completed service with the employer.

When calculating the duration of service, any fraction of a year is disregarded. For instance, if an employee has served for a total of 20 years and 9 months, the period taken for the purpose of this calculation will be considered as 20 completed years.

Definition of Salary

The meaning of 'salary' specifically includes the employee's basic salary and dearness allowance (DA), but only

if the DA is part of the terms of employment for computing retirement benefits. It also includes any commission

that is paid as a fixed percentage of turnover achieved by the employee.

Related: An Expert’s Guide to the Salary Slip Format

This definition explicitly excludes all other allowances, such as house rent allowance or travel allowance, as well as perquisites, bonuses, or other special payments. For non-government employees, the calculation uses the average salary drawn over the ten months immediately preceding the date of their retirement or resignation.

Employer's Leave Policy

The internal leave policy of the employing organization has a direct bearing on the final exemption amount. The company's rules dictate how many days of earned leave an employee can accumulate per year and what the process is for carrying them forward.

While a company's policy might allow an employee to accumulate more than 30 days of leave in a year, the income tax law restricts the calculation for tax exemption purposes to a maximum of 30 days per completed year of service. The final leave balance at credit is determined by deducting the total leave availed by the employee during their tenure from the total leave they were entitled to accumulate under the company's policy (subject to the tax law's cap).

Budget 2025 Update

No changes to leave encashment tax rules in Budget 2025.

The ₹25 lakh exemption limit introduced in 2023 remains unchanged, providing stability for retirement planning. This continuity in the law provides certainty for employees and employers in planning for retirement and final settlements.

Timing of the Encashment

The point at which an employee chooses to encash their leave is a critical factor that determines its taxability. If an employee encashes their earned leave while still in service, the amount received is considered part of their salary income for that financial year and is fully taxable. This applies to both government and non-government employees, although some tax relief under Section 89 may be claimed.

The tax exemption under Section 10(10AA) is applicable only to the lump-sum amount received upon the cessation of employment, whether through retirement, superannuation, or resignation. It is this final payment for unutilised leave that is subject to the exemption calculations detailed here.

The Statutory Limit

The government imposes a maximum monetary ceiling on the amount of leave encashment that can be claimed as tax-exempt by a non-government employee. Following the Union Budget 2023, this statutory limit was significantly increased to ₹25,00,000.

This ceiling is a lifetime limit for an individual. If an employee has previously worked for another company and claimed a portion of this exemption upon leaving, that amount is deducted from the total available limit. For example, if an individual had claimed an exemption of ₹4,00,000 in a previous job, the maximum additional exemption they could claim from all future employers combined would be ₹21,00,000.

Conclusion

In summary, the answer to is leave encashment taxable is a definite "yes," but it comes with powerful exemptions. The tax treatment ultimately depends on where the person is working right now. For government employees, it is entirely tax-free upon retirement under the leave encashment rules for central government employees. For everyone else, the tax liability depends on a careful calculation using the 4-factor formula.

This is where accurate data matters. Using reliable payroll management software ensures that earned leave balances, payouts, and historical records are maintained correctly making tax computation smoother and error-free.

A little bit of planning and good record-keeping throughout the career will go a long way in making sure the person receive the full tax benefit that have rightfully earned. Ultimately, accurate record-keeping and proactive planning are essential for ensuring receive the full tax benefit entitled to under the earned leave encashment rules.

FAQ

Is leave encashment taxable for all employees?

Yes, leave encashment is taxable if the person receives it while still working, regardless of whether they are in the government or private sector. However, if they receive it at the time of retirement or resignation, there are important tax exemptions available depending on your employer type.

What is the tax exemption for leave encashment at retirement?

For government employees, the entire leave encashment amount received at retirement is fully tax-free. For private sector employees, only a portion is exempt, up to the lowest of four amounts: the actual amount received, ₹25 lakh (lifetime limit), ten months’ average salary, or the cash equivalent of unutilised leave.

How is the exempt amount calculated for private sector employees?

The exempt amount is the lowest of these four values: the actual leave encashment received, ₹25 lakh (lifetime limit), ten months’ average salary (basic + DA), or the cash value of unutilised leave (calculated as unutilised days divided by 30, multiplied by monthly average salary). Only the exempt portion is tax-free; the rest is taxable.

Can I claim leave encashment exemption more than once in my career?

No, the ₹25 lakh exemption limit is a lifetime limit. If you have already claimed part of this exemption from a previous employer, the remaining amount is what you can claim from future employers. The total exemption across all jobs cannot exceed ₹25 lakh.

Is leave encashment tax-free if received by my family after my death?

Yes, if your legal heirs receive the leave encashment amount after your death, the entire sum is fully tax-free in their hands, regardless of whether you were a government or private sector employee.

Comments