5 Basic Steps in Processing Payroll - What's Actually Involved?

Posted On:- 03 June, 2025 By:- Vaibhav Maniyar

Whether your payroll is handled by the Human Resources (HR) or Finance departments, through outsourcing or a third-party provider, everyone goes through five basic steps at the end of the month. The distinction is what they do or how they approach it via numbers based on size, volume or calculation required depending upon the company policy regarding payment management. In India, these five steps must align not just with internal policies but also with statutory mandates such as the Payment of Wages Act, Minimum Wages Act, and the Income Tax Act.

Introduction

Before we get into the five basic steps in processing a payroll, it is important for you to know what kind of payroll you are about to process. For instance, Provident Fund (PF) contributions must be calculated as per the EPF Act, Professional Tax varies state-wise, and TDS under Section 192 must align with the individual's tax slab after exemptions and deductions. To put it simply, each kind has its own balance of human-based calculation and automation required to complete the task effectively and efficiently. But what is payroll processing really, and why does it seem more complicated than it should be?

What is Payroll?

Definition: Payroll is the step-by-step process a company follows to calculate and pay salaries to its employees. It includes everything from tracking the number of days worked, calculating earnings and deductions, to finally transferring the salary to the employee's bank account and keeping a record of it. Professional experts are hired to process the amount correctly, on time, and in full compliance with the law.

Each month, the payroll process includes:

Preparing a list of active employees

Calculating their gross salary (based on attendance, overtime, or performance)

Subtracting deductions like Provident Fund (PF), Tax Deducted at Source (TDS), Professional Tax, and any other company policies (like loan EMI or meal coupons)

Arriving at the net salary

Transferring the amount to employee accounts

Filing required returns and maintaining records for audits

As mentioned earlier, in India, payroll is usually processed monthly and must follow various rules under the Income Tax Act, the Payment of Wages Act, the Employees' Provident Fund Act, and others. Errors in payroll can lead to penalties for the company and frustration for employees.

Today, most businesses use payroll software or outsourcing services to manage payroll smoothly. But whether done manually or digitally, payroll remains one of the most sensitive and essential parts of running a business.

A well-managed payroll ensures:

Employees are paid on time

The company stays compliant with laws

All records are clean and auditable

Trust and morale remain high in the workforce

5 Basic Steps in Processing Payroll

Below is a breakdown of the five fundamental steps in payroll processing - explained not in a checklist format, but as a logic-driven flow designed to show how one step sets the stage for the next.

Step 1: Data Collection

Everything begins with data. Before a single rupee is calculated or disbursed, the organisation must collect and validate employee-specific data for the given pay cycle.

This includes gathering information related to employee attendance, leaves, approved overtime, role changes, promotions, resignations, and benefits claimed. HR is typically the custodian of this information, but finance depends on its integrity. Any mismatch here cascades into miscalculations later. What's critical to understand is that no software, however sophisticated, can correct a poorly maintained upstream data flow.

Many payroll errors in Indian companies originate from outdated records or manual overrides that go unnoticed until audit season.

Step 2: Salary Computation

With the inputs in place, the next step is to compute the salary payable. This step is mathematical on the surface, but conceptual in depth. It involves understanding not just the number of days worked, but also how the salary is structured, and what is eligible for deduction or exemption.

The standard salary structure in Indian companies includes basic pay, HRA, special allowances, performance bonuses, and reimbursements. Deductions typically include the employee's share of Provident Fund (12% of basic pay), Professional Tax (as per state slab), Employee State Insurance (for wages ≤ ₹21,000), and TDS (under Section 192 of the Income Tax Act). One must also account for recovery of advances, unpaid leaves, or any other policy-based deductions.

This is where payroll processing becomes legal arithmetic. The numbers are governed by laws. For instance, not deducting PF correctly can trigger penalties under the Employees' Provident Funds, 1952.

Related: Decoding Your Paycheck: Everything About Payroll Structure Explained!

Step 3: Verification and Approval

Once calculations are complete, the payroll register must go through internal checks and validations. This stage is often rushed in smaller companies, but it is here that risks are mitigated.

A line-by-line audit of the payroll output helps catch anomalies such as double payments, unrecorded resignations, or incorrect tax computations. This is also the stage where CFOs or HR heads must approve the final salary outflow. The bank transfer files, payslip PDFs, and compliance challans should be generated only after this internal approval loop is completed.

It is important to treat payroll verification as a controlled process, not a casual review. For example, Section 9 of the Code on Wages, 2019 mandates transparent wage calculation and payment records, which makes this verification phase legally significant.

Step 4: Salary Disbursement

The Payment of Wages Act, 1936 requires that wages be paid by the 7th of the following month for organisations with fewer than 1,000 employees, and by the 10th for larger ones.

Most companies in India now use bulk salary disbursal systems linked to their payroll software or ERP. A bank advice file is uploaded directly to the company's net banking platform or via payment gateways integrated through APIs. Simultaneously, payslips must be generated and shared with employees through secure HRMS portals or via email.

Step 5: Post-Payroll Compliance

Payroll is not complete until the company files the appropriate returns and deposits statutory dues with the respective government bodies.

This includes depositing:

PF contributions with the EPFO by the 15th of each month

ESI contributions with the ESIC, also by the 15th

TDS with the Income Tax Department by the 7th

Professional Tax to state governments as per local deadlines

Quarterly TDS returns (Form 24Q), annual Form 16 distribution, and reconciliation with the company's general ledger must also be completed as part of post-payroll responsibilities. These are not formalities. Failure to file or delay in remittances invites penalties, prosecution, and scrutiny under the Income Tax Act and EPF & MP Act, among others.

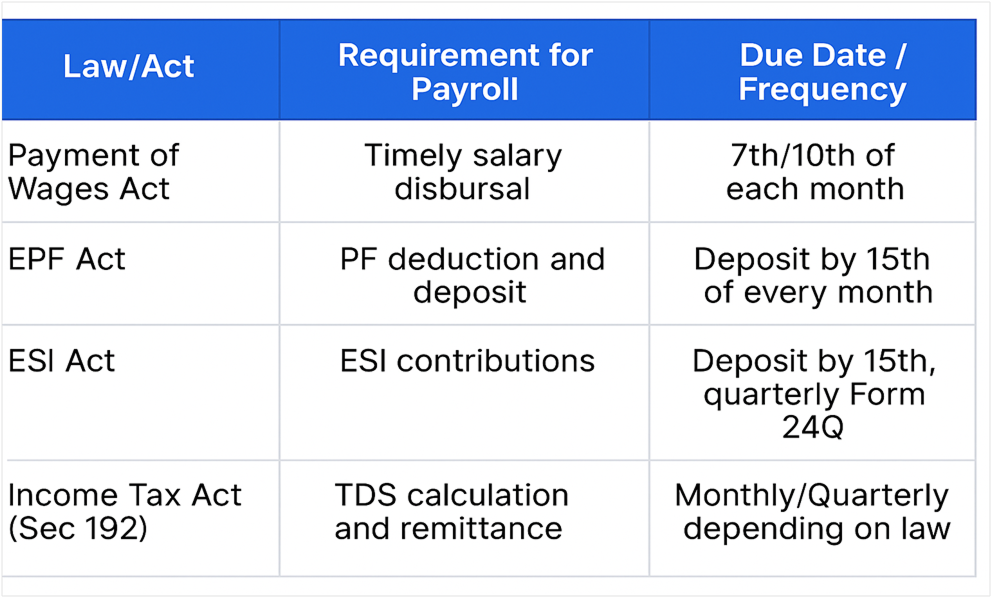

Payroll Compliance Calendar: Key Acts, Requirements, and Due Dates for Timely Processing in India

What distinguishes a compliant organisation from a reactive one is not how it processes payroll - it's how it archives it. Every challan, payslip, approval email, and audit trail must be retained and ready for inspection. In case of a labor dispute, tax notice, or audit, these records are your legal defence.

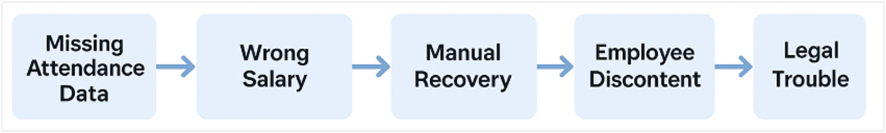

What Happens If You Miss a Step in Payroll?

Payroll may feel repetitive. But it is a legally and financially binding sequence. Every step is part of a chain. Let's look at what actually happens when each step is ignored, abbreviated, or left unmonitored.

Skipping even one weakens the entire structure.

Not Collecting Data, the Right Way

If you skip or mishandle the pre-payroll data collection stage, you risk feeding incorrect inputs into your salary calculations. For example, if an employee resigned mid-month but the HR system wasn't updated in time, they may receive a full month's pay. Or worse, if the attendance software didn't sync correctly, you may penalize someone for being absent when they were actually on approved leave. Either way, it results in rework, reputational cost, and often, manual recovery attempts that further erode trust.

Miscalculating Numbers

Imagine under-calculating HRA or failing to adjust for revised salary increments. A small error repeated over multiple months compounds into large tax mismatches. On the other hand, overcalculating net salary without adjusting for PF or TDS can result in non-compliance with the Income Tax Act or EPF Act, both of which can trigger notices, back payments, and in some cases, interest or penalties.

Not Verifying Your Numbers

Skipping or rushing through payroll verification and approval may seem tempting during busy financial closings, but it is a legal blind spot. Without formal approvals, finance teams disburse funds without clear audit trails, which becomes a red flag during statutory audits or due diligence, especially for funded startups or MNCs operating in India.

Related: Choose the Best Payroll Software for Your Small Business

Delaying Salary Disbursement

If salary disbursement is delayed or partial, the impact is immediate and visible. Under the Payment of Wages Act, employers are obligated to credit salaries within prescribed timelines. Repeated delays can result in formal complaints to labor officers. For startups or mid-sized firms, these issues often escalate on platforms like LinkedIn or Glassdoor, undermining employer branding. In sectors with high attrition, such lapses directly affect retention and hiring.

Missing Post-Payroll Compliance

If post-payroll compliance is missed, the penalties are not just administrative; they are financial and reputational. For instance, late deposit of PF or TDS attracts interest and penalties under Sections 201(1A) and 221 of the Income Tax Act. Further, failure to issue Form 16 on time violates Section 203 of the Act and can invite notices both to the employer and employee. In many cases, compliance errors trigger systemic reconciliation problems in quarterly filings or during annual tax audits, complicating even future payrolls.

How a Cloud-Based Payroll System Changes the Game?

Modern cloud platforms now implement statutory computation, allowing independent versioning of tax logic, deduction slabs, and exemption rules. For example, TDS under Section 192 is computed dynamically based on the current FY's slab rate + any Section 10 exemptions + valid 80C declarations, all processed via user-facing declarations.

Moreover, PF contribution logic (12% of Basic + DA, capped or uncapped based on wage ceiling) is system-enforced, not user-entered. The ₹15,000 wage ceiling under EPF is hardcoded unless explicitly overridden for higher voluntary contributions, with employer liability calculated accordingly.

Furthermore, once payroll is approved, the platform generates bank payment advice in the format required by your banking partner (ICICI, HDFC, SBI, etc.) along with unique transaction references (UTRs) tagged against each salary disbursal, mapped for audit trail continuity and instant NEFT/RTGS integration through net banking or payment gateway APIs.

Lastly, cloud-based payroll systems now follow immutable ledger models - all payslip versions (draft, approved, post-revision) are stored. TDS revisions post-investment proof validations reflect in Form 24Q reconciliation as delta entries, preserving previous remittances and calculating differential tax with Form 16 alignment.

Even in high-volume setups, cloud systems such as MinopCloud are fully API-enabled, allowing real-time sync of employee joiners, exits, attendance, shift rosters, and chart-of-accounts integration for salary booking in Tally, SAP, or Oracle NetSuite.

Conclusion

These five steps form the backbone of an organisation's financial hygiene. Whether you're processing payroll in-house, through software, or via an outsourced partner, the responsibility remains yours. Skipping a step might not show up immediately, but it accumulates until one day, it surfaces in an audit, a lawsuit, or a resignation letter citing "irregular salary payments." This is why seasoned payroll professionals treat every step not as a formality, but as a control.

FAQs

What components make up an effective payroll architecture in India?

An effective payroll architecture integrates accurate employee data, automated statutory calculations, controlled verification, secure disbursement, and audit-ready compliance. It starts with validated master and attendance data, ensuring pan, UAN, salary structure, leave, and overtime are up-to-date. This feeds into calculation engines that segment earnings and deductions.

How does automating PF and TDS enforce legal compliance?

Automation enforces compliance by embedding statutory logic into the system. PF contributions are computed at 12% of Basic + DA – capped at ₹15,000 unless higher voluntary contributions are opted for-and the system auto-generates EPFO-compliant ECR files. TDS is calculated as per current tax slabs, investment declarations (Sections 10, 80C), and updated dynamically.

What are the statutory deductions in Indian payroll, and how are they calculated?

Statutory deductions in Indian payroll are governed by central and state-level laws, designed to ensure social security, tax compliance, and professional accountability. The key deductions include:

Provident Fund (PF): 12% of Basic + Dearness Allowance, under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. Employers contribute a matching 12%, part of which is diverted to EPS (pension).

Employee State Insurance (ESI): Applicable for employees earning ≤ ₹21,000/month. Deducted at 0.75% of gross wages from the employee and 3.25% from the employer (as per latest rates by ESIC).

Professional Tax (PT): Levied by state governments; varies by slab and location. For instance, Maharashtra deducts ₹200/month if salary > ₹10,000.

Tax Deducted at Source (TDS): Calculated under Section 192 of the Income Tax Act based on estimated annual taxable income minus declared exemptions (Sections 10, 80C, etc.).

These deductions are legally mandated and must reflect accurately in payslips, salary registers, and filings like Form 24Q or ECR uploads. Incorrect deduction or non-remittance can trigger penalties under multiple acts, including interest under Section 201(1A) of the Income Tax Act and damages under Section 14B of the EPF Act.

What are the statutory deadlines for payroll compliance in India?

Statutory compliance in payroll is deadline-driven and legally binding. Key due dates include:

PF & ESI Deposits: 15th of the following month

TDS Payment: 7th of the following month

Professional Tax (PT): Varies by state, usually monthly

Quarterly TDS Return (Form 24Q): 31st July, 31st Oct, 31st Jan, 31st May

Form 16 Issuance: By 15th June following the financial year

Missing these deadlines invokes legal and financial consequences. For instance, delayed TDS deposit triggers interest under Section 201(1A) and can lead to disallowance under Section 40(a)(ia). PF delays attract penalties and damages under Section 14B of the EPF Act. Failure to issue Form 16 on time violates Section 203 and can affect employees' tax filings.

How is cloud-based payroll more compliant than traditional payroll systems?

Cloud-based payroll systems embed statutory logic, version control, and real-time audit trails into their architecture – making them inherently more compliant than spreadsheet-based or on-premise systems. For instance, TDS under Section 192 is auto-adjusted with updated slab rates, exemptions (Section 10), and investment declarations (Section 80C), eliminating manual miscalculation risk. EPF calculations respect statutory ceilings (₹15,000 wage cap) unless explicitly overridden. These systems also auto-generate EPFO-compliant ECRs, Form 24Q data exports, and even bank payment advice files – all traceable and versioned.

Comments