Decoding Your Paycheck: Everything About Payroll Structure Explained!

Posted On:- 22 April, 2025 By:- Vaibhav Maniyar

Understanding your payroll structure is super important. It's not just about knowing your take-home pay. A good payroll structure ensures fairness for everyone. It also keeps companies on the right side of the law. Plus, happy employees are often well-compensated employees!

This guide will walk you through the typical payroll structure you might see, especially in India. We'll break down the common pieces. Knowing these basics helps companies create fair pay systems. It helps employees understand their earnings better too. Employers can pay transparently this way. They can also manage taxes smartly following the rules.

So, let's unravel the mystery behind your pay. What exactly goes into that final number? Let's dive in!

What Exactly is a Payroll Structure in India?

A payroll structure or a salary structure includes your basic pay, various allowances, maybe bonuses, and other benefits. It clearly shows what your employer commits to paying you. Moreover, you can also see the deductions, like taxes or provident fund contributions.

A well-designed payroll structure in India needs to juggle a few things. It must follow labor laws. It has to comply with tax regulations. It should also meet industry standards. A smart payroll structure balances your gross pay (total before deductions) and net pay (what you take home). It cleverly uses deductions to be tax-efficient where possible.

Common Parts of a Payroll Structure

Your pay isn't just one big number. It's built from several different components. Here are the usual suspects:

1. Basic Salary

This is the core of your earnings. It's a fixed amount you receive before any extras or deductions. Your basic salary often makes up about 40-50% of your total package (CTC). What determines it? Your job title plays a big role. The industry you work in matters too. Many other parts of your pay, like certain allowances, are calculated based on this basic amount. Keep in mind, this part is fully taxable.

2. Allowances

Allowances are extra payments for specific needs or expenses. Think of them as targeted support. Some might be fully taxed. Others might be partly taxed, offering some savings. A few could even be tax-free! The types and amounts vary from company to company. It all depends on their internal policies.

Dearness Allowance (DA)

This allowance helps offset the rising cost of living (inflation). It's usually a percentage of the basic salary. You mainly see this for government and public sector employees. Important note: DA is fully taxable.

House Rent Allowance (HRA)

Paying rent? HRA helps cover that cost. If you live in rented accommodation, you might get tax benefits on your HRA. This can lower your overall tax bill, sometimes quite a bit! Don't rent? Then this allowance is fully taxed for you. Tax rules can change, so always check current regulations, especially regarding different tax regimes.

Conveyance Allowance (Travel Support)

This used to help cover travel costs between home and work. Fun fact: a 'standard deduction' was introduced a few years back. This standard amount often replaces separate transport and medical allowances now. It simplifies things a bit! So, you might not see this listed separately anymore.

Leave Travel Allowance (LTA)

LTA helps cover travel costs within India when you're on leave. Want a tax break on your holiday travel? LTA can help! But there are rules. It only covers actual travel costs (flights, trains, buses). It's limited to the amount your employer provides. You can usually claim this twice in a block of four years.

Medical Allowance

Like the conveyance allowance, this fixed amount for medical expenses is often covered by the standard deduction now. If paid separately, it's typically fully taxable.

Books and Periodicals Allowance

Some companies offer this to help pay for work-related reading materials. Think books, journals, or newspapers. You might get a tax exemption based on actual spending if you provide bills.

3. Perquisites (Perks)

Perks, or 'perquisites', are non-cash benefits some employees get. It often depends on their job role or seniority. What kind of perks? Maybe a company car for personal use. Perhaps rent-free accommodation. Even things like club memberships could count. These perks have a monetary value. That value gets added to your salary for tax purposes.

4. Bonus

Who doesn't love a bonus? It's extra compensation on top of your regular salary. Companies might give bonuses for great performance. They might use them to thank long-serving employees. Sometimes, bonuses help attract new talent. Bonuses you receive are generally taxable in the year you get them.

5. Gratuity

Gratuity is a lump-sum payment. Employers usually pay it when an employee retires or leaves after long service. Generally, you need at least five continuous years with the company to qualify. Think of it as a reward for your dedication. Tax rules for gratuity can be a bit complex. They depend on whether you're a government or private employee. They also depend on whether your employer is covered under the Payment of Gratuity Act. There are tax exemptions available, often up to a certain limit.

Related: Understand Payroll Processing in India

Common Deductions

Your gross salary isn't what lands in your bank account. Certain amounts are deducted first.

Professional Tax (PT)

This is a small tax levied by some state governments. It applies to salaried employees and professionals (like doctors, lawyers). The rules and amounts differ by state. However, the maximum allowed is ₹2,500 per year. Your employer deducts this and pays it to the state.

Employee State Insurance Contribution (ESIC)

If your company qualifies (based on employee count) and your gross salary is below a certain limit (currently ₹21,000/month), ESIC applies. It provides medical and social security benefits. Both the employer and employee contribute a small percentage of the gross salary.

Employee Provident Fund (EPF)

EPF is a mandatory retirement savings scheme. A portion of your basic salary (plus DA, if applicable) goes into your EPF account. Your employer usually contributes an equal amount. This builds a nice nest egg for your future.

Tax Deducted at Source (TDS)

This is the income tax deducted directly from your salary. Your employer calculates it based on your income slab and investments (if declared). They pay it to the government on your behalf throughout the year.

CTC, Gross Salary, Net Salary

You hear these terms thrown around. Let's clarify!

Cost-to-Company (CTC):

This is the total amount your employer spends on you in a year. It includes your basic salary, all allowances, bonuses, and the employer's contributions (like their share of PF, insurance premiums, etc.). CTC is always the biggest number. It represents the company's total cost for employing you.

Gross Salary:

This is your total earnings before any deductions are made. It's your basic salary plus all allowances and bonuses you receive directly.

Net Salary (Take-Home Pay):

This is the actual amount credited to your bank account. It's your Gross Salary minus all deductions (PF, ESI, Professional Tax, TDS). This is the money you can actually spend!

So, remember: CTC > Gross Salary > Net Salary. Don't confuse CTC with your take-home pay!

What's a Salary Breakup?

A salary breakup simply shows how your total CTC is divided into different parts. It itemizes your basic salary, allowances, employer contributions, and potential deductions. Your offer letter often includes a detailed salary breakup. It promotes transparency. You can clearly see where the money is going.

How Do Companies Decide on Salary Components?

HR and payroll teams use various methods to define the parts of a payroll structure. They need to balance company strategy, legal rules, and fairness.

Fixed Salary Method:

Focuses on stable components like basic pay. This makes payroll costs predictable.

Performance-Based Method:

Links parts of pay (like bonuses) to achieving targets. Common in sales roles.

Cost of Living Adjustments (COLA):

Pay might vary based on location. HRA is often higher in big cities.

Flexible Benefits Method:

Lets employees choose some components. Maybe pick between HRA, meal coupons, or transport options based on personal needs. This boosts satisfaction!

Industry Benchmarks:

Companies check what competitors pay for similar roles. This keeps their compensation competitive.

Types of Payroll Structures: Top-Down vs. Bottom-Up

Companies might build their salary structure in two main ways:

Top-Down Structure:

Starts by defining individual components (basic, HRA, etc.). Then adds them all up to get the gross salary. This offers flexibility in setting each part.

Bottom-Up Structure:

Starts with a target gross salary figure. Then breaks it down into components based on company rules (e.g., basic is 50% of gross). This is useful when focusing on a total pay package first.

Taxability: Which Parts Get Taxed?

Understanding tax is key to understanding your net pay. Here’s a quick overview:

Fully Taxable:

Basic Salary, Dearness Allowance, Medical Allowance (if separate), Bonuses, Overtime pay.

Partially Taxable:

House Rent Allowance (HRA), Leave Travel Allowance (LTA), Children's Education Allowance (up to limits). Tax benefits depend on specific conditions being met.

Non-Taxable (Often Reimbursements):

Reimbursements for phone/internet bills (based on actuals, within limits), potentially books/gadgets used for work (with proof).

Disclaimer: Tax laws change! Always refer to current Income Tax regulations or consult a tax professional for specifics.

Calculating Your Payroll Structure

Calculating the structure involves putting all the pieces together.

Total Earnings (Gross Salary):Add Basic Salary + All Allowances + Bonuses.

Total Deductions:

Add Employee PF contribution + ESI contribution (if applicable) + Professional Tax + TDS (Income Tax).

Net Salary (Take-Home):

Gross Salary - Total Deductions.

CTC:

Gross Salary + Employer's PF contribution + Employer's ESI contribution (if applicable) + Gratuity contribution (accrued) + Insurance premiums paid by employer, etc.

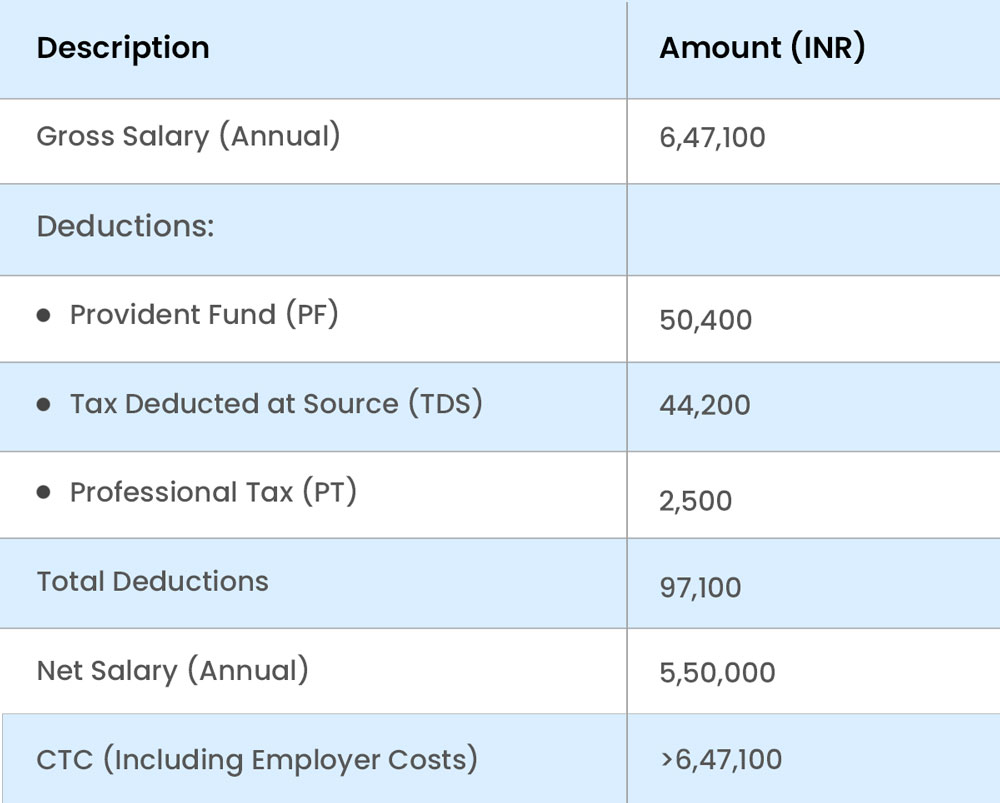

Let’s understand this breakdown with the help of an example in the table below:

A simple PF, TDS and PT deductions from the annual salary of 6,47,100 yields to 5,50,000 which is not the CTC by definition. Here, the CTC including the employer costs would be higher than the gross salary.

Related: 6 Reasons Why Spreadsheets Aren't Ideal for Managing Payroll

Tips for Employers Creating a Payroll Structure

Building a great payroll structure is crucial for any business.

Maximize Employee Savings:

Structure pay smartly. Use tax-friendly components like HRA and LTA correctly. Help employees reduce their tax burden legally.

Manage Employer Costs:

Be mindful of components like Basic Salary. Higher basic pay can increase employer contributions to PF, ESI, and gratuity. Find a good balance.

Ensure Compliance:

Always follow the rules! Adhere to minimum wage laws. Make correct contributions to EPF, ESIC, and Gratuity. Deduct taxes accurately. A compliant salary structure avoids legal trouble.

What Determines Your Payroll Structure?

Several factors influence how pay is structured and how much you earn:

Your Background:

Education and years of experience matter significantly. More qualifications usually mean higher pay.

Location, Location, Location:

Working in major cities often commands higher salaries. This reflects the higher cost of living there.

Industry:

Some industries (like IT, finance) typically pay more than others. Market demand plays a big role.

Skills:

Specialized skills (like AI, data science) are in high demand. They often lead to better pay packages.

A clear, fair payroll structure is essential. It's built from various components like basic pay, allowances, and deductions. Understanding your salary structure helps you know your true earnings and tax implications. For companies, a well-designed payroll structure made by a cloud-based payroll management software is vital. It helps attract and keep talented employees, ensures legal compliance and builds trust and transparency. By getting the structure right with Minop, companies create a win-win for everyone involved!

Frequently Asked Questions

1. What is the formula for calculating salary structure?

Your Net Salary (take-home) is your Gross Salary minus all Deductions (like your PF contribution, income tax, professional tax). Your CTC (Cost-to-Company) is generally your Gross Salary plus the costs your employer pays (like their share of PF, gratuity accrual, insurance).

2. What is the CTC for 60,000 salary per month?

Remember, CTC is always higher than your gross or net salary! Why? Because it adds employer costs like their Provident Fund contribution, maybe insurance, and gratuity amounts. The exact CTC depends heavily on the specific payroll structure your company uses and how they break down those components.

3. Are PF and gratuity taxable?

Your Employee Provident Fund (EPF) contribution is a deduction that goes into your savings. It's generally not taxed when it's deducted. Gratuity paid when you retire or leave after long service often has tax exemptions! But the rules can be tricky. They depend on whether you're a government or private employee and the amount received. There are limits to the exemption, so it's good to check the details for your situation.

4. Is it compulsory to deduct HRA from salary?

HRA isn't something deducted from your salary! It's actually an allowance your employer might pay to you as part of your payroll structure. It's meant to help cover your house rent costs. It's not a mandatory deduction. Whether you get HRA depends on your company's policy. If you do get it and pay rent, you might be able to claim tax benefits!

5. What is the average difference between CTC and in-hand salary?

The difference includes things you pay (like your PF share, income tax, professional tax) AND things your employer pays (like their PF share, insurance premiums, gratuity provision). Because tax slabs and company policies vary so much, there's no single 'average' percentage difference. It really depends on your specific income level and the unique payroll structure offered by your employer.

Comments